has been showing remarkable growth thanks to increasing credit card penetration and high percentage of the youth in total population. Fueled further by internet penetration of over 35% and over 30 million online shoppers, the e-commerce grew by 45% in 2013.

has been showing remarkable growth thanks to increasing credit card penetration and high percentage of the youth in total population. Fueled further by internet penetration of over 35% and over 30 million online shoppers, the e-commerce grew by 45% in 2013.

According to a report released by Payfort during the ArabNet Digital Summit 2014, an online payment provider in the Arab region, e-commerce volumes are expected to continue rising in next three years as a result of increased internet and credit card penetration in markets such as Saudi Arabia and Egypt, where only 14% and 4% of the population are transacting online.

Despite the region’s high e-commerce growth rates, 80% of online transactions are still made via cash on the delivery. This situation creates hard time as well as tremendous growth opportunities for e-payment tech and service providers.

The report covers e-commerce and e-payment trends in larger MENA region and gives detailed analyses of digital markets in the United Arab Emirates, Saudi Arabia, Kuwait and Egypt. It says 23.5% of online users in these four markets own a credit card, meaning cash dependence still remains a problem for the e-commerce sector. However with credit card issuance growing by more than 40% every year, the Arab world’s cash payment “problem” will be solved in the near future together with a booming e-commerce and e-payment sectors.

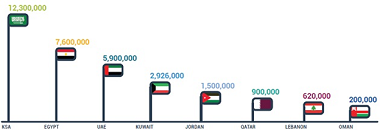

Payfort’s research also finds out that Saudi Arabia has the highest amount of circulating credit and debit cards (12.3 million units) followed by Egypt (7.6 million) and the UAE (5.9 million). The remaining countries on this list are Kuwait, Jordan, Qatar, Lebanon, and Oman with 2.9 million, 1.5 million, 0.9 million, 0.62 million, and 0.2 million, respectively.

(12.3 million units) followed by Egypt (7.6 million) and the UAE (5.9 million). The remaining countries on this list are Kuwait, Jordan, Qatar, Lebanon, and Oman with 2.9 million, 1.5 million, 0.9 million, 0.62 million, and 0.2 million, respectively.

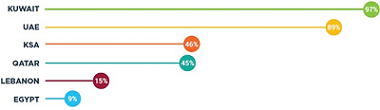

Per capita penetration of credit/debit cards is highest in Kuwait though (with 97%). The UAE follows with 89%, Saudi Arabia and Qatar with 46% and 45%.

For the entire report, you can click here for a downloadable version.

Trackbacks/Pingbacks

[…] PAYFORT, the Arab world’s leading online payment provider, announced yesterday at an iftar the launch of its PayForward Initiative, an e-knowledge sharing and networking space that aims to connect startups with seasoned entrepreneurs who are willing to offer the needed mentorship to “fast forward the entrepreneurial ecosystem” in the region, as Omar Soudoudi, Managing Director at Payfort, puts it. […]

[…] Regional payment gateway Payfort has released its latest infographic providing an overview of the core markets in Egypt, KSA, Kuwait and the UAE. It includes insight into consumer behavior, the travel market and what we can expect in years to come. You can also read the full report here. […]