Being part of the e-Business industry for a while I have seen adoption of Alternate Banking channels (Internet and Mobile  Banking) growning in the region. Globally there are some countries that are very bullish about the technology and some still prefer face to face banking.

Banking) growning in the region. Globally there are some countries that are very bullish about the technology and some still prefer face to face banking.

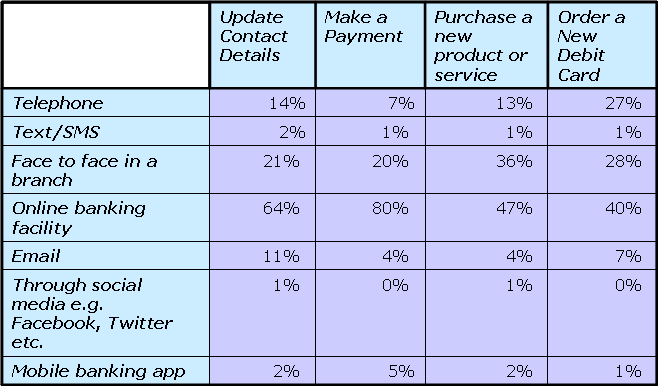

Recently HSBC released a Global Survey on Expats which shows the preference of Alternate Banking Channels. According to the survey 80% of expats conduct their banking online when making a payment. In comparison, only a fifth (20%) of expats make a payment face-to-face in a branch, while much smaller proportions use the telephone (7%) or mobile phone apps (5%).

When it comes to Middle East the survey says that many people still prefer face-to-face banking. Face-to-face banking is more appealing for making payments, with expats in Oman (38%), Kuwait (30%), Saudi Arabia (26%), the UAE (26%) and Bahrain (26%) being more likely to favour this method of communication with their bank for making payments. More than half (55%) of expats in Oman would prefer to research products and services in branch compared to a global average of only one in five (21%)

This also shows that there is a huge opportunity in the e-Banking space to increase the penetration rates. Colleagues in the e-Banking industry tell me that the big local banks in UAE would have 35%-40% Internet Banking penetration. The challenge has always been to keep the customer active. Many International banks in UAE would have around 40%-45% penetration rate.

According to a report published by Infosys, spending on online banking channels is expected to touch US$ 50 million in 2012 in Middle East and Africa. Mobile Banking is a great opportunity in the region as countries like UAE and Qatar have 90%+ penetration rates. Most of the 20+ kids carry 2 handsets (Blackberry for the BBM and iPhone for web use)

Interestingly the survey shows that Social Media has not played an effective roll in helping the customer conduct their banking activities.

The below table shows how expats choose to bank globally.

HSBC Expat Survey is conducted among more than 5,000 expats based in 30 countries responded in 2012.