The Middle East and Africa Personal Computer market suffered losses during the fourth quarter of 2013 due to the increasing demand for tablet devices, according to the International Data Corporation (IDC). PC shipments in EMEA totaled 25.8 million units in the fourth quarter of 2013, a 6.7% decline from the same period last year. However, the decline was less steep than the last seven quarters. All areas of the region — Western Europe, Eastern Europe and the Middle East and Africa — showed a shipment decline.

IDC said PC shipments into Turkey, the Middle East and Africa declined by 14% year-on-year during the fourth quarter. The sale of portable PCs declined by 18% while desktop computers experienced a 7.8% decline.

“End users in the MEA region continue to opt for enhanced mobility, shifting to sleeker, lighter and smaller devices with longer battery lives,” said Fouad Rafiq Charakla, research manager for personal computing, systems, and infrastructure solutions at IDC Middle East, Africa, and Turkey.

“As a result, the shift from desktops to portable PCs and from portable PCs to tablets and smartphones continues apace. Furthermore, even within the portable PC segment, there is a notable shift underway from traditional notebooks to convertible notebooks and ultraslim notebooks,” Rafiq said.

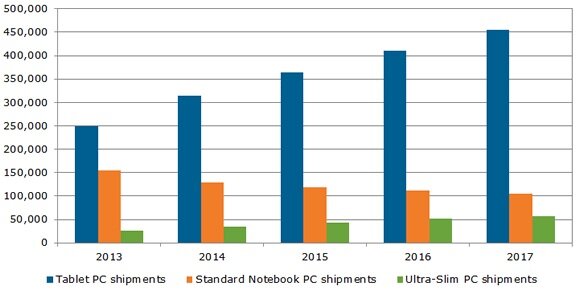

Falling prices and advances in display technology will lead to higher shipments of tablet PCs, which will increasingly replace notebook PC shipments in 2014 and beyond. According to the NPD DisplaySearch Quarterly Mobile PC Shipment and Forecast Report, global tablet PC shipments will rise to 315 million in 2014, comprising more than 65% of the market. By 2017 tablet PC shipments will climb to 455 million, encompassing nearly 75% of the mobile PC market.

The worldwide tablet PC average selling price is expected to fall from $311 in 2014 to $296 in 2017, which will help increase adoption, particularly in emerging regions where first-time PC buyer penetration rates are the highest. As new technologies and features hit the market, consumers will have more options to choose from, including AMOLED and other display technologies, a greater variety of screen sizes, and higher resolutions.

“Competition is expected to increase as traditional notebook PC brands, including Lenovo, HP, and Dell update their product portfolios to emphasize tablet PCs. Increased competition will mean more attention on, and development of, various segments of the market, which will ultimately lead to greater choice and devices that better fit the needs of consumers.”